FEATURES

Single entrepreneur – the difficult years and the Russian trade

(Excerpted from the autobiography of Merrill, J. Fernando)

The early 1970s were difficult years for all businessmen in the country. The changes on the political front and the progressive policy of Ceylonisation resulted in forcing the foreign company owner out, but, simultaneously, created doubt in the minds of the potential local investor/entrepreneur. The Marxist doctrine which underpinned State economic policy and attitude did little to encourage the spirit of private entrepreneurship, unless it was for a few individuals who, for various reasons, found favour with the Government.

The exit of expatriate business families such as the Joneses (of AF Jones) did enable politically-unaffiliated locals such as me, to get a toehold in the tea export business. Given my strongly-held views on the tea export trade, particularly the British domination of the industry, which was highly detrimental to the interests of the producer with its sublimation of the real value potential of the authenticity of Pure Ceylon Tea, I would certainly have eventually set out on my own. The opportunity may not have come so early though, if not for the decidedly ‘foreigner unfriendly’ stance of the first Bandaranaike Government.

In 1974 I launched Merrill J. Fernando Exports Ltd., of which I was the sole owner. I believe this was a turning point in my business career as a tea exporter, for I was able to build on and consolidate on the back of the contacts I had made and the connections that I had established, in most countries of the tea-drinking world. The fact that the company bore my name was later a huge advantage that I did not foresee when I started marketing ‘Dilmah’ as a highly-personalized family brand. The latter eventually became its unique selling point. Whilst unhesitatingly conceding the element of good fortune – divine intervention, in my view – that is inherent in every success story, there was always my readiness to grasp opportunities as they presented themselves, in spite of the ever-present risk element.

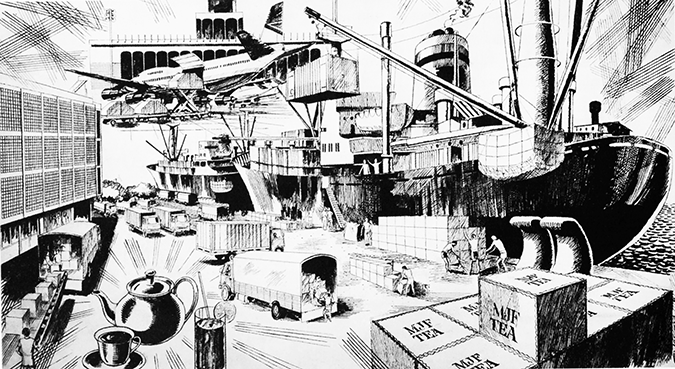

I became the fourth largest exporter in the country when, in 1974, Merrill J. Fernando Co. Ltd. exported 24 million pounds of tea. It gave me business satisfaction as I was competing with the giants in the country, but exporting bulk tea to blenders and packers abroad never gave me the sense of achievement I was looking for. It was not a challenge as such an enterprise does not require vision or real skill. One had only to be competitive. The entire process was concerned only with generating volume, which had nothing to do with creating real value. But my long involvement in the bulk tea trade gave me knowledge and experience of the trade, and the trading disciplines, which served me well later when I started marketing my own brand.

My contacts in the USSR began playing a very significant role in my business and the subsequent development of the ‘Dilmah’ brand. Before the dissolution of the USSR, I would visit Moscow at least four or five times a year, mainly in connection with the supply of bulk tea. Grigory Pipinov, who became my friend when he was Deputy Russian Trade Commissioner in Sri Lanka, was of great help to me. During his stint in Sri Lanka, he and his wife Lilian were frequent visitors to my home. He was also a great cook and would spend much more time and effort organizing his frequent barbecue parties, for which he bought the beef from a particular butcher in Borella, and marinate for hours in my kitchen! The level of culinary perfection he required, in his view, could be achieved only by himself.

On all my visits to the USSR, I would be met at the airport by two or three officials and conducted to the National Hotel, the only equivalent then to a five-star hotel in Moscow. It had been built in 1903, during Czarist times, and was located close to both the Red Square and the Kremlin. My meetings were mostly with Grigori Pipinov and Bathov, Chairman of Sojuzplodoimport (Sojuz). The latter was also an extremely nice man and I developed very good relationships with the two, and all of the others that I dealt with. I gained their confidence as, in all my dealings with them, I was absolutely straightforward and they soon they realized that my agenda was what was on the table.

The tea trade in Russia was controlled by the State-owned Sojuz, a Moscow-based entity established in 1966 for the import of various food items in to Russia, including coffee and cocoa. It also owned a couple of premium vodka brands, such as Stolichnaya and Moskovskaya. Despite the subsequent breakup of the Soviet Union and the privatization of many previously State-controlled trade arms, control of Sojuz was retained by the State.

Whilst it was operating under State control, Sojuz imports of tea amounted to about USD 1.5 billion in value, annually. India accounted for about 60% of it, in volume. The balance was made up by China, Indonesia, Vietnam, Sri Lanka, and Bangladesh, collectively. Up to about 1988, average annual imports by the bloc amounted to about 135 million kilos. In the years 1989-1991, the volume reached 200 million kilos and in 1992, increased further to 260 million kilos. Till then, all the tea imported to the CIS bloc (Confederation of Independent States – 11 countries initially, increasing to 12 with the addition of Georgia in 1993), was processed in 16 tea packaging factories spread out across the bloc, and distributed to retail shops at fixed prices, under an agreement with the Ministry of Food and Industry and the Ministry of Internal Trade. The entire process, from importation of bulk to the cup of the consumer, was controlled by the State.

Tea and Perestroika

In 1988, when the Soviet Union collapsed, Russia wanted to import 20,000 MT per month. I agreed to give my buyers 500 MT and then gradually increase it to 1,000 MT. For me, it was a golden opportunity. Pipinov indicated to me that they were considering purchasing Dilmah tea exclusively, in 250 gm and 500 gm packs. I was invited by him to travel to Russia, to meet his Chairman, Bathov, and within a week I was in Moscow.

They accepted whatever price I quoted to them and, in order to maintain the trust in the relationship, I always ensured that my prices stayed reasonable in the context of the prevailing market. I believe that they were fully aware of this. Between 1988 and 2002, I used to ship an average of 100×40 ft. containers per month of bulk tea to Russia. Initially, whilst the dealings were directly with the Russian Government, trading conditions and commercial interactions were stable and reliable. I shipped tea to various ports in the USSR. However, with the dissolution of the Soviet Republic and the consequent muscling in of the Russian Mafia in to the trade, the business became fraught with difficulties and physically dangerous to other participants.

When I first started supplying large volumes against the Sojuz orders, as a result of my heavy buying, the Colombo Auction prices shot up by about Rs. 15 per kilo and I had to absorb substantial losses on my first order. I had indicated to Bathov and Pipinov that I would be quoting a very moderate price on the first order, but that I would have to adjust it thereafter, as I knew for a certainty that the auction price would increase sharply. That is exactly what happened.

On my next trip to Moscow, when Bathov asked me about my losses resulting from the tea market upturn, I told him that irrespective of the bottom line, I would maintain the agreed quality of service. He asked me for my new price for the second order – adjusted by me to cover my previous loss – and actually insisted that I increase it. I made a further small adjustment, but still kept it at a reasonable level. The fact that I did not try to exploit their urgent need for tea to my advantage established trust between us.

The new contracts enabled me to recover the losses I made on the earlier orders and start on the road to profit. I made certain that, irrespective of Colombo Tea Auction price fluctuations, I delivered consistent quality and freshness. This was the business which, for a considerable period of time, made ‘Dilmah’ a household name in Russia and also paved the way for its subsequent successes in other countries.

This importance of establishing one’s credentials with the buyer with the very first order is an invaluable first principle, which I learned for myself when, during my time as a trainee tea taster, I did a little extra business by supplying shops in Negombo with tea. I used to impress on my people in the company, from the very inception, that the tea export trade is a business of frequently-fluctuating fortunes. The latter is directly tied to auction price movement and the first principle is, irrespective of the auction price, to maintain consistent quality. If you supply lower quality to maintain profit, the loss of the buyer is a guaranteed consequence. If you stay the course with integrity, you will eventually prosper.

I entered the Russian trade when the socialist bloc was one nation and, over the years, watched its fragmentation even as I continued to ply my trade with them. One immediate result of the break-up was the sudden increase in tea import volumes, surging from around 135 million kg in 1988 to 260 million kg by 1992. At the time of the dissolution, only the Republic of Russia had the infrastructure for the import and export trade. Therefore, the release of tight state controls and the sudden exposure to a free market environment, presented opportunities to aspiring private sector entrepreneurs to move into an area which, previously, had no direct dealings with local traders.

Our marketing blunder and a lost opportunity

Our traders foolishly misinterpreted Russian market preferences, assuming that it would be an ideal destination for cheap tea, which could be sold with large margins. In fact, this misjudgment of the CIS market – as it later came to be called – even led to requests by our traders for a revision of minimum product standards in exports to Russia. What the newcomers to the Russian trade failed to realize was that even under the previous State monopoly, Russia had been purchasing largely quality tea and that despite the liberalization, the market’s expectations of Ceylon Tea did not change. As a result, eventually, the fly-by-night operators were forced to drop out, whilst the reputed, established brands stayed the course.

The Russian market could be roughly segmented in to four. At the bottom there was space for cheap blends. Then there were the slightly superior blends which came largely from the UK and, above that, Dilmah, noted for its consistent quality. At the top level were a few specialty products from well-known UK brands. A matter of interest was that a few of the multinational and European brands of tea, whilst being expensive, were also of consistent good quality. Those brands were a serious threat to Ceylon Tea, on account of their quicker delivery capability from destinations close to Russian ports, and, also because of their reliable quality.

With my emphasis on supplying quality tea at a proportionate price, as the first major Sri Lankan entrant to the Russian market, I was able to establish a valuable quality principle in the expectation of the Russian consumer of Ceylon Tea. The disintegration of the Soviet Union and the consequent dismantling of the State-controlled centralized purchasing policy was an ideal entry opportunity for our exporters to develop our own brands for export to the newly-created independent states. The market was surging and the Russian buyer was literally at our mercy. However, in the import/export free-for-all which ensued at the fall of the Soviet Union, many of our traders, despite my warnings, entered into cheap bargains with Russian traders to packet and supply low-cost tea under Russian labels instead of establishing purely Sri Lankan/Ceylon Tea brands.

With the fragmentation of the Soviet Union, in addition to Sri Lanka, countries such as Indonesia, China, Kenya, and India became active suppliers to the separate states of the original Soviet Union. Collectively, these states comprised the world’s largest single Black Tea market (apart from Indian internal consumption) and I confidently expected the market, jointly, to eventually move up to 300 million kg, annually.

In my experience, when a previously centrally-controlled market is opened for competition, within a matter of months consumers decide on brand preferences, depending on quality, presentation, and price. Once those standards are established in the minds of the consumers, it is difficult to wean them away. Had we quickly developed a strategy by combining both State and private resources to secure a reasonable share of the CIS market by treating it as a preferred region, we would be exporting 120 million kg to that market, annually, today, provided our national production continued to increase at a reasonable rate, ensuring that supplies to other markets did not suffer as a result.

In fact, in March 1993, I made such a proposal to Mr. R. Paskaralingam, then Secretary of the Ministry of Policy Planning and Implementation, suggesting that the Tea Board, Export Development Board, and Central Bank, should pool appropriate resources in developing a marketing plan for the CIS bloc in its entirety. I also offered my total support to such a project, backed by my knowledge and experience in the Russian trade.

3rd March, 1993

Mr. R. Paskaralingam,

Secretary,

Ministry of Policy Planning and Implementation, 123, Wijerama Mawatha,

COLOMBO 7,

Dear Mr. Paskaralingam,

MARKETING STRATEGY TO GUIDE USSR – CIS IMPORTS TOWARDS SALVAGING CEYLON TEA INDISTRY

For many years, we were the major supplier of bulk tea to the former USSR, outside the period when it was a monopoly of Consolexpo. In respect of Value Added Teas, we were the exclusive supplier. In the final year, leading to the breakup of the USSR, our Value Added exports were in excess of Rs. 1 billion.

In the years 1991 and 1992, there were hardly any exports, due to political and economic crisis prevailing in CIS countries,The position leading to exports to CIS countries took a dramatic turn in the last three months, when demand for Value Added Tea, from all Tea producing countries, escalated. India, Indonesia, China, Kenya and Sri Lanka are active in supplying these Republics, at the present time. Within the next six months, consumers will determine their preferences for quality and presentation, which will lead to market share, for each country or product, in what is the world’s largest single tea market.

CIS importers know nothing about tea or private trade, as yet. In this scenario, they are exploited by intermediaries, who contract to supply tea at good prices and draw stock from suppliers in this country at very low prices, for very poor tea. CIS consumers pay high prices for relatively poor tea. This exercise benefits only intermediaries in Europe, UK, USA, Canada and some other countries.

The total CIS market for tea is approximately 300 million kilos, p.a. and it will grow steadily.A suitable strategy must be developed immediately, to secure a good share of this market, for Ceylon tea, which I believe will be 50 million in 1993 and no less than 120 million per year, from 1994, provided we treat CIS as a preferred market and make a concerted effort, using the SLTB, EDB and Central tank to co-operate very closely, towards evolving a marketing plan, which I shall assist in formulating.

I have no doubt that exports to CIS countries will increase Auction price levels, to guarantee the operation of Plantations profitably, if opportunities in that market are harnessed for the benefit of Ceylon tea.

Considerable harm to the image of Ceylon tea has already been caused by misguided exporters, who are shipping very poor tea. Government should not watch this situation helplessly, as it will deny to Ceylon tea, a golden opportunity to balance its annual budget, if the export trade is correctly guided and monitored, in respect of exports to CIS countries.

TEA SMALL HOLDERS FACTORIES LIMITED

I understand that TEA SMALL HOLDERS FACTORIES LIMITED is due for privatization shortly. I shall be prepared to acquire a 51 % stake in it and develop the Company to produce value added teas, at plantation level, and export direct to CIS countries. This would offer maximum possible return to small holders and workers on these plantations. In fact, I may be able to persuade a CIS investor, with tea interests, to participate in this venture. This would be a model on which several ” growers’ co-operatives”, could be developed to manufacture value added products, for direct export.

I shall be leaving for Australia on 15th March and would like to meet with you, soon after your return from the U.S. If you agree with what I suggest, I am prepared to delay my departure by 3 or 4 days, in order to get the marketing plan underway, in association with SLTB, EDB and the Central Bank.

With kind regards,

Yours sincerely,

MERRILL J. FERNANDO,