Former CBSL Chief justifies ISB borrowings

Tuesday, 11 March 2025 02:43 – – 8

- Dr. Indrajit Coomaraswamy says SL would have collapsed sooner without ISBs

- Asserts borrowing during his tenure was to serve existing debt rather than fund new ones

- Clarifies debt strategy was designed to buy time, extend maturities and move away from short-term, high-cost borrowings

By Charumini de Silva

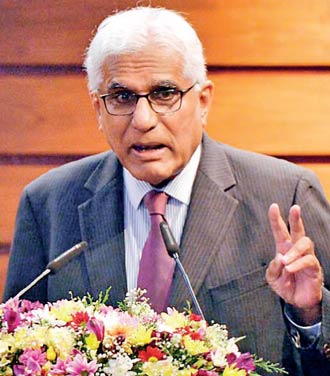

Former Central Bank Governor Dr. Indrajith Coomaraswamy – Pic by Pradeep Pathirana

|

Former Central Bank Governor Dr. Indrajith Coomaraswamy yesterday rejected criticism that the surge in International Sovereign Bond (ISB) borrowings during his tenure contributed to the country’s foreign exchange crisis, arguing much of that debt was used for liability management and to prevent an earlier financial collapse.

He made this observation responding to a remark at the first public event organised to mark the 75th anniversary of the Central Bank titled: ‘A new paradigm in macroeconomic management.’

Dr. Coomaraswamy explained the borrowing strategy was a necessary evil to keep the county solvent.

The former Governor acknowledged that the country’s ISB exposure tripled from $ 5 billion in 2015 to $ 15 billion in 2019, but insisted that nearly half of this increase stemmed from restructuring short-term high-risk instruments, rather than new debt accumulation.

“Of the $ 10 billion increase, around $ 5 billion was due to switching instruments. In 2015, Sri Lanka had $ 3.5 billion in volatile rupee securities, which we brought down to $ 600 million. We also slashed swaps from $ 2.5 billion to $ 500 million. The decision to replace these with ISBs was a deliberate strategy to reduce cost and improve financial stability,” he explained.

Dr. Coomaraswamy also addressed concerns about the $ 4.5 billion in ISBs raised in 2019, before the Presidential Election, describing it as a ‘buffer’ against the risk of policy shift under a new Government, which he feared would pull out of the IMF program and lose access to capital markets.

“Post-Easter bombings, it was evident that the Government would change. We anticipated a shift in economic policy, including the possibility of exiting the IMF program.

Market sentiments however were still strong and our advisers told us we could raise additional funds – something I found surprising given the Constitutional crisis in 2018 and the bombings. But we had passed the Active Liability Management Act, published a medium-term debt strategy and set out an export strategy. These reassured investors and thus we decided to take the money and build reserves to give the incoming Government some breathing space – hoping they would return to the IMF if needed,” he elaborated.

Dr. Coomaraswamy maintained that most of the borrowing during his tenure was to service existing debt at the time, rather than new expenditure.

He also cited a Verité Research report, which found that between 2015 and 2019, 89% of total borrowings were used to repay previous debt, whilst also referring to a 2017 World Bank report that noted 90% of Sri Lanka’s total borrowings that year went toward repaying old debt.

“The reality is, the Government was borrowing just to stay afloat,” he added.

Without fresh ISB issuance, the former CBSL Chief argued that the country would have defaulted much earlier.

“Our debt strategy was designed to buy time, extend maturities and move away from short-term, high-cost borrowings. If we had stopped raising ISBs, the default would have happened much sooner,” he said.