AKD allure: Value of CSE rises by Rs. 1 trillion

Friday, 13 December 2024 05:03 – – 18

President Anura Kumara Dissanayake

- ASPI crosses 14,000 points mark first time ever as investors turn more optimistic

- Since election of AKD, market capitalisation has risen to Rs. 5.13 trillion from Rs. 4 trillion

Investors in the Colombo stock market appear to show growing signs of attraction to President Anura Kumara Dissanayake-influenced optimism with its value soaring by Rs. 1 trillion since his election and the benchmark index yesterday crossing the 14,000-points level for the first time in its history.

Investors in the Colombo stock market appear to show growing signs of attraction to President Anura Kumara Dissanayake-influenced optimism with its value soaring by Rs. 1 trillion since his election and the benchmark index yesterday crossing the 14,000-points level for the first time in its history.

Sustaining the indices in green for the 13th consecutive day, the benchmark ASPI and the active S&P SL20 yesterday gained by 1% but that was enough to set new records.

The ASPI closed the day at 14,035 points, crossing the physiologically important 14,000-points mark. This was after the ASPI reached an all-time high of 13,511.73 on 4 December surpassing the previous best level on 19 January 2022. Year to date gain of the ASPI was 31.74% and that of S&P SL20 was 36.44%.

Prior to the 21 September Presidential election, the market capitalisation of Colombo Stock Exchange (CSE) was Rs. 4 trillion and by yesterday it had risen to Rs. 5.13 trillion reflecting a jump of Rs. 1 trillion.

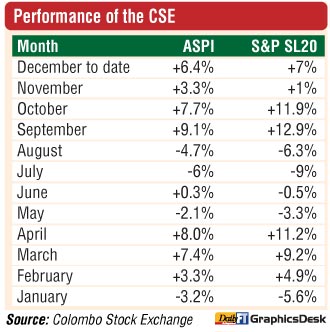

Aided by the late burst in sentiment following Dissanayake’s election, the CSE has enjoyed three consecutive months of gains after declines in July and August and lacklustre performance earlier on. So far in December the upward trend has been more prominent. Some analysts opined that in less than three months, the socialist President Dissanayake has been able to boost investor sentiments than the seemingly pro market, private sector-friendly and reformist Ranil Wickremesinghe during his two year tenure.

Others however noted that low interest rate regime was a key factor for recent rally in the stock market along with re-rating of upside for equities following impressive corporate earnings along with finalisation of external debt restructuring and progress in the program with the International Monetary Fund among other positives.

First Capital said the majority of investor attention yesterday was focused on Banking sector stocks, along with companies in the Food, Beverage, and Tobacco sector like LMF, as well as Construction sector stocks such as JAT, and ACL. Additionally, BREW, HNB, SAMP, JKH and COMB emerged as the top positive contributors to the index. Amidst multiple off-board transactions and increased participation from retail investors, turnover rose to Rs. 7.4 billion marking an increase of 76.8%, from the monthly average. Turnover was led by JKH (Rs. 923 million), Lanka Milk Foods (Rs. 631 million), Alumex (Rs. 476 million), Digital Mobility Solutions (Rs. 298 million) and Sampath Bank (Rs. 266 million).

The Capital Goods sector led the turnover by 24%, followed by the Banking and Materials sectors jointly contributing 35% of the overall turnover. The market also saw a net foreign inflow of Rs. 306.6 million yesterday signalling interest in internal investments.

NDB Securities said the ASPI closed in green as a result of price gains in counters such as Ceylon Beverage Holdings, Hatton National Bank and Sampath Bank.

It said high net worth and institutional investor participation was noted in Alumex, John Keells Holdings and Asiri Hospital Holdings. Mixed interest was observed in Lanka Milk Foods, Digital Mobility Solutions Lanka and Sampath Bank whilst retail interest was noted in HNB Finance, Lanka Credit and Business Finance and Hela Apparel Holdings.

The Capital Goods sector was the top contributor to the market turnover (due to John Keells Holdings) whilst the sector index gained 1.25%. The share price of John Keells Holdings increased by 30 cents to Rs. 21.40.

The Banking sector was the second highest contributor to the market turnover (due to Sampath Bank) whilst the sector index increased by 1.41%. The share price of Sampath Bank appreciated by Rs. 2.25 to Rs. 105.

Lanka Milk Foods, Alumex and Digital Mobility Solutions Lanka were also included amongst the top turnover contributors. The share price of Lanka Milk Foods gained Rs. 2.60 to Rs. 36.10. The share price of Alumex moved down by 10 cents to Rs. 13.10. The share price of Digital Mobility Solutions Lanka recorded a gain of Rs. 1.50 to Rs. 66.